Guided Borrower Flow

Guide customers through collecting basic information about themselves and their businesses, collect and screen documents, and re-engage customers who drop-off

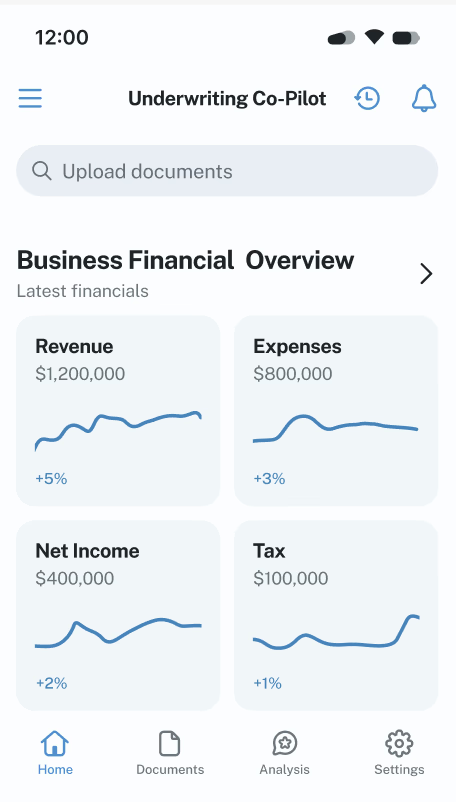

Sophisticated Analysis

Automatically ingest documents, synthesize and clean data, spread tax returns and calculate key metrics like DSCR

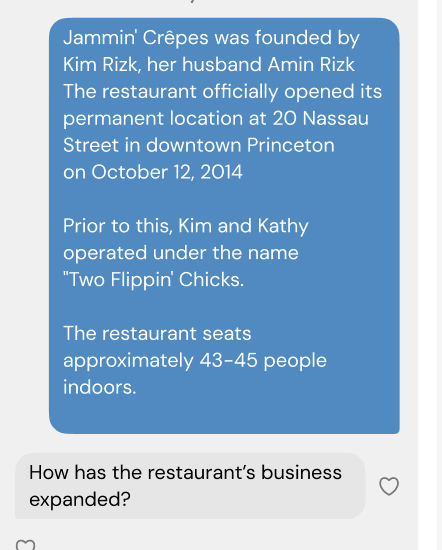

Research

Deeply research the business by aggregating information across web, government sources and KYB APIs

Backed by South Park Commons

Backed by South Park Commons